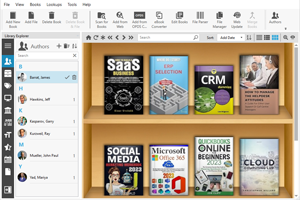

4 books on Accounting Software [PDF]

Updated: February 27, 2024 | 15 |

Books on Accounting Software serve as essential references for startups specializing in accounting software development. These resources provide a comprehensive foundation, covering various aspects of accounting software, from the principles of financial accounting and taxation to software design and implementation. They delve into advanced techniques for creating robust, user-friendly accounting software that automates financial tasks, enhances accuracy, and ensures compliance with tax regulations. These books often include practical examples, case studies, and insights into the latest trends and technologies in the accounting software industry, enabling startups to grasp the complexities and demands of the field.

1. Quickbooks desktop pro 2022 starter guide

2022 by kylie Cox

This comprehensive guide, "Quickbooks Desktop Pro 2022 Starter Guide," is an invaluable resource for individuals seeking efficient ways to handle routine tasks essential to their business without the need for costly accounting services. Whether you're just starting out or looking to streamline your financial processes, this guide offers practical insights into QuickBooks Desktop Pro 2022. Covering topics such as accepting multiple transactions in batches, adding and managing users, creating and managing invoices, handling quotes, and customizing the program to align with your business needs, this guide ensures you make the most of the software's capabilities. With step-by-step instructions, you'll learn essential tasks like creating accounts, importing data from Excel or CSV, leveraging multi-currency features, linking bank accounts, and much more. Tailored for business owners and professionals, this guide enhances your skill level and empowers you to make informed financial decisions, ultimately contributing to increased profitability. Don't miss the opportunity to optimize your use of QuickBooks Desktop Pro 2022 – click the "BUY NOW WITH 1-CLICK BUTTON" on the top right corner, get your copy, and start reading!

Download PDF

2. Accounting All-in-One For Dummies

2022 by Michael Taillard, Joseph Kraynak, Kenneth W. Boyd

"Embark on a comprehensive and accessible journey through the intricacies of the accounting process with the newly revised Third Edition of "Accounting All-In-One For Dummies with Online Practice." Authored by finance expert Michael Taillard, this resource guides you through every facet of accounting, from setting up your accounting system to auditing and detecting financial irregularities. The book offers a cohesive collection of mini-books, complemented by online practice and video resources, consolidating all essential accounting knowledge into one convenient volume. Whether you're learning to record transactions, adjust and close entries, or prepare financial statements, this edition provides valuable insights. With online instructional videos reflecting the digital age's modern accounting reality, advice on making informed financial decisions, and practice quizzes, this resource is perfect for beginners, accounting enthusiasts, and business professionals seeking a better grasp of the financial aspects of commerce."

Download PDF

3. Xero: A Comprehensive Guide for Accountants and Bookkeepers

2021 by Amanda Aguillard

Explore the ins and outs of Xero, the burgeoning accounting and bookkeeping software, with "Xero: A Comprehensive Guide for Accountants and Bookkeepers." Geared towards US-based advisors seeking an alternative to shifting competitors, this comprehensive how-to guide covers the spectrum of features found in Xero's Established subscription plan. Authored by Amanda Aguillard, the book not only introduces the fundamentals of navigating Xero but also provides invaluable best practices for streamlining bookkeeping workflows within this cloud-based platform. By bridging the gap between accounting theory and Xero's interface, Aguillard ensures a holistic understanding of the processes involved. In an era of interconnected tech tools, the guide goes a step further by demonstrating seamless integration of Xero with other cloud-based software, fostering a harmonious operation. From mastering the US version's interface to optimizing Xero's features, this guide, complemented by a companion website packed with templates, serves as the ultimate resource for accountants and bookkeepers looking to elevate their proficiency in this global accounting software platform.

Download PDF

4. Digital Accounting: The Effects of the Internet and ERP on Accounting

2006 by Ashutosh Deshmukh

"Diving into the realm of digital accounting, "Digital Accounting: The Effects of the Internet and ERP on Accounting" establishes a solid groundwork by exploring essential subjects like accounting software, XBRL (eXtensible Business Reporting Language), and EDI. Examining the impact of the Internet and ERP on accounting, the book categorizes and elucidates their effects on each accounting cycle, accompanied by a thorough exploration of online controls. Offering a conceptual approach, this book delves into the latest advancements where accounting and IT intersect, providing a comprehensive understanding of the evolving landscape in this dynamic field."

Download PDF

How to download PDF:

1. Install Google Books Downloader

2. Enter Book ID to the search box and press Enter

3. Click "Download Book" icon and select PDF*

* - note that for yellow books only preview pages are downloaded

1. Quickbooks desktop pro 2022 starter guide

2022 by kylie Cox

This comprehensive guide, "Quickbooks Desktop Pro 2022 Starter Guide," is an invaluable resource for individuals seeking efficient ways to handle routine tasks essential to their business without the need for costly accounting services. Whether you're just starting out or looking to streamline your financial processes, this guide offers practical insights into QuickBooks Desktop Pro 2022. Covering topics such as accepting multiple transactions in batches, adding and managing users, creating and managing invoices, handling quotes, and customizing the program to align with your business needs, this guide ensures you make the most of the software's capabilities. With step-by-step instructions, you'll learn essential tasks like creating accounts, importing data from Excel or CSV, leveraging multi-currency features, linking bank accounts, and much more. Tailored for business owners and professionals, this guide enhances your skill level and empowers you to make informed financial decisions, ultimately contributing to increased profitability. Don't miss the opportunity to optimize your use of QuickBooks Desktop Pro 2022 – click the "BUY NOW WITH 1-CLICK BUTTON" on the top right corner, get your copy, and start reading!

Download PDF

2. Accounting All-in-One For Dummies

2022 by Michael Taillard, Joseph Kraynak, Kenneth W. Boyd

"Embark on a comprehensive and accessible journey through the intricacies of the accounting process with the newly revised Third Edition of "Accounting All-In-One For Dummies with Online Practice." Authored by finance expert Michael Taillard, this resource guides you through every facet of accounting, from setting up your accounting system to auditing and detecting financial irregularities. The book offers a cohesive collection of mini-books, complemented by online practice and video resources, consolidating all essential accounting knowledge into one convenient volume. Whether you're learning to record transactions, adjust and close entries, or prepare financial statements, this edition provides valuable insights. With online instructional videos reflecting the digital age's modern accounting reality, advice on making informed financial decisions, and practice quizzes, this resource is perfect for beginners, accounting enthusiasts, and business professionals seeking a better grasp of the financial aspects of commerce."

Download PDF

3. Xero: A Comprehensive Guide for Accountants and Bookkeepers

2021 by Amanda Aguillard

Explore the ins and outs of Xero, the burgeoning accounting and bookkeeping software, with "Xero: A Comprehensive Guide for Accountants and Bookkeepers." Geared towards US-based advisors seeking an alternative to shifting competitors, this comprehensive how-to guide covers the spectrum of features found in Xero's Established subscription plan. Authored by Amanda Aguillard, the book not only introduces the fundamentals of navigating Xero but also provides invaluable best practices for streamlining bookkeeping workflows within this cloud-based platform. By bridging the gap between accounting theory and Xero's interface, Aguillard ensures a holistic understanding of the processes involved. In an era of interconnected tech tools, the guide goes a step further by demonstrating seamless integration of Xero with other cloud-based software, fostering a harmonious operation. From mastering the US version's interface to optimizing Xero's features, this guide, complemented by a companion website packed with templates, serves as the ultimate resource for accountants and bookkeepers looking to elevate their proficiency in this global accounting software platform.

Download PDF

4. Digital Accounting: The Effects of the Internet and ERP on Accounting

2006 by Ashutosh Deshmukh

"Diving into the realm of digital accounting, "Digital Accounting: The Effects of the Internet and ERP on Accounting" establishes a solid groundwork by exploring essential subjects like accounting software, XBRL (eXtensible Business Reporting Language), and EDI. Examining the impact of the Internet and ERP on accounting, the book categorizes and elucidates their effects on each accounting cycle, accompanied by a thorough exploration of online controls. Offering a conceptual approach, this book delves into the latest advancements where accounting and IT intersect, providing a comprehensive understanding of the evolving landscape in this dynamic field."

Download PDF

How to download PDF:

1. Install Google Books Downloader

2. Enter Book ID to the search box and press Enter

3. Click "Download Book" icon and select PDF*

* - note that for yellow books only preview pages are downloaded